Where are we?

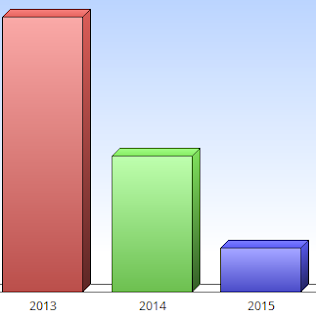

Look! This makes me soooo happy! Over the last year we have reduced our student loan debt by almost $10,000!!!! We still have a long way to go, but seeing the difference from 2013/2014 and 2014/2015 makes me so glad we refinanced Justin's student loans. My suspicion is that next year we will see even more of a decrease than that since we didn't refinance until midway through the year. Perhaps a $20,000 decrease next year? Or more since we won't be buying a car? I can only hope…

Our payoff date is still remaining steady at Feb. 2023. (8 years?! Blech!)

Credit card debt is down by about $2000? Maybe? I mean – at least it's down and not up. We're looking at a May 2016 payoff date, but that may or may not get moved around since we have a few interest free credit cards. It's much better, in my opinion, to have a debt that isn't growing while paying down a debt that is (due to interest rates). Of course the interest free card option won't always be available. Our goal is always to pay off the interest free card that we owe on by the time the interest free period ends – whether that means moving the money around (using, at most, a 1% transfer fee) or paying it off completely (always the preference).

A $5,000 increase in assets is nothing to sneeze at. We had our peak in June reaching a high of $9,000 more in savings than we had in 2014, but that quickly dwindled away with the purchase of a car and computer. Oh well. Better luck next year?

Last year, this was the chart that made me most happy. This year I just want to hide my face in shame. Of course Mint is partially to blame, but they fixed the error of their ways sometime in October/November, so I had the chance to get back on track for a few months. Plus, knowing there was a problem, I could have tracked my expenses more closely. But I didn't. :( This year we spent approximately $11,000 more than we did last year (car purchase included). Granted by August there was no way for us to make up for the extra $10,000 in spend; it was what it was. BUT we could have spent less in the months following by eating out less and shopping less. Even a meager $500 a month over the course of 4 months adds up! Maybe in 2016 I'll get back on track; after all, spending less than you did the year before is not exactly an easy task. I do believe it is one of the most difficult financial goals we currently have!

Our net income was another disappointment this year. In July we bought Justin a computer, me a tablet, and then screens to fix both of our phones. It was pretty miserable, but we were confident we could overcome the excess spend in August … That is, until we discovered that I needed a new car. :( Another month down for the count. Then, I was struggling to get my act together for preparing for our European vacation shortly. When I finally realized the trip was coming whether or not I was ready, we ended up spending far too much in November buying boots, sweaters, cell phones, hotel stays, train tickets, show tickets, etc… At least this month, when we finally get to where we are going, we will mostly be paying for food and activities. So that's nice. (#excuses)

As an aside, we had an average monthly net income of +$1,200. Overall, it's not too bad. An increase for 2016 would be nice though. I'd love to pull the net income that I did in the early months of 2015 in 2016 (+$2,000).

Our net worth is gradually improving. It's improved by approximately $4,000 from last year, a notable increase from the $2,000 increase last year. And by increase, I really mean decrease. As in we are in the negative now working our way toward positive – a few thousand at a time.

Stocks are down by 1.7%, but they fluctuate so much on a day to day and weekly/monthly/yearly basis… Neither Justin nor I directly handle our stocks. With so much debt, we're trying to focus on that. One day though I'd like to learn about the stock market and play around with it. I've heard doing so is kind of like finding a great sale at your favorite store. I could totally get behind that. :)

Interest charged – I think we learned our lesson. Of course, this only coincides with credit cards. We've also saved a lot on interest charges this year with regards to our student loan consolidation. Yay Earnest!

Overview of the biggest impacts on our finances in 2014:

1. Car purchase. Ouch.

2. Huge tax refund! Wow!

3. Travel. Yay!

4. Student loan refinancing. Less interest.

5. Electronics upgrades. Needed.

So where were the downfalls? What went wrong financially this year?

1. Having to buy a car. We weren't in a financial position to buy a car without going into more debt. Equally, I wasn't about to buy a car that would need replacing in 5 years; I wanted something that would last. We opted for a more expensive newer model vehicle (yet still used so we wouldn't lose the cost from driving it off of the car lot). It's a nice car, but if I hadn't been worried about paying down debt and keeping my job, I'm not sure I would have gotten it. Justin still drives my old car to work to save on gas, so it was definitely fixable and remains usable despite the problems that caused me to buy the new car in the first place.

2. Traveling. We went to NC, SC, TN, FL, NY, MA, and NJ. It's been a busy year. But we've seen so many people that we love. So financially, it was terrible. But for a million other reasons, it was the right (best) thing to do.

3. Upgraded electronics. Justin got a laptop – his first in over 3 years! Plus we both got iphones and used amazon money to pay for a Nexus 6 to use Project Fi for our trip to Europe. Expensive but probably necessary.

4. Not sticking to budget. When you need something within a 2 or 3 month period, it's hard to not buy the first thing you like. And when you are busy it's hard to think about how much you are spending on food.

5. On the same note, Mint sucking. When they stopped letting me compare month-to-month, I became more susceptible to spending. I didn't have that helpful push to stay below 2014's budget. It's back working now, so goal for 2016?

What went right this year?

1. Refinancing Justin's student loan. With a lower interest rate, I have confidence we are paying loans down faster than we were before.

2. Getting a large tax refund. It meant we had to start paying down my student loans, but we needed to start doing that anyway…

3. Keeping credit card debt at 0% interest rates. We did open up new cards to keep that interest rate, but it should help in the long run…

4. Taking on some awesome jobs to get things for free – hotel stays ($600+ value), dinners, movies, books, music, and a smart thermostat ($240 value)! Yay!

5. We paid off one loan in full. :)

What are our plans/goals for next year?

1. Paying off a debt of some sort. Preferably credit card debt, but I'd take any debt.

2. Sell things. We started working on that some this year, but we didn't get very far…

3. Spend less than we did in 2016 but still have awesome life experiences. I know it's possible!

4. Cut out unnecessary spending. Dropbox, credit cards with fees, and an unused cell line are the ones that come to mind right now.

5. Get credit scores even higher. They are hanging in the lower to mid-700s for both of us, but I love the idea of having a high range 700 score or even 800!

6. Save more. I'd love to find a high(er) interest savings account and take advantage of bank deals for opening new accounts. (Free money ftw?!)

What are your financial goals for 2016? Are there things you are particularly proud to have accomplished in 2015? Anything you are particularly disappointed in? What did you learn this year that you hope will influence your spending and budgeting goals for 2016?

* I'm participating in Susannah Conway's December Reflections. Are you? Today's post was a response to #24 on the list "One Year Ago".