Finances –

For those of you just joining the blog from the A-Z challenge, I take a look at my finances twice a month to consider how my husband and I are doing and where we are in conquering our debt. Unfortunately, this month we aren't doing too good, but it's good to go through and see it. Plus, in a few months when I've paid it all off, posts such as this will make me feel incredibly good and hopefully inspire others. (Or at least that's my goal.)

Successes:

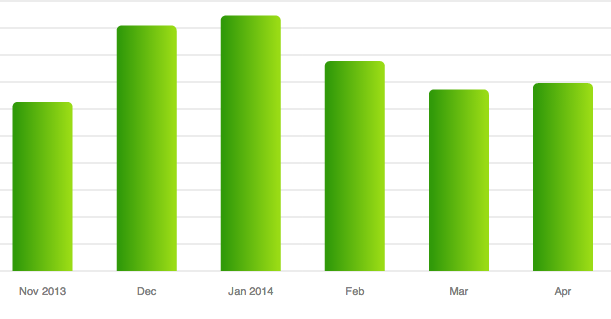

By some miracle we owe less than we did last month and have more in assets than we did last month.

|

| Debt down by .01% (I'll take it!) |

|

| Assets up by .03% |

Downfalls:

We're still paying for European vacation things AND in the middle of moving. Costs will occur.

Inside My Wallet –

Ok, if I'm going to be honest with you all, I don't actually have a "wallet" per-say. I don't like carrying a purse. One of the only reasons I carry a purse is if I'm going to a job interview or I need a small bag to carry my camera in. (Yes, I have been known to stuff my DSLR into an over the shoulder bag no bigger than … well, one camera and a lens.) My pockets are plenty big enough to fit everything I need on a daily basis.

Since this is a finance post, I decided for the letter 'I' to include what is typically on me or would be in my wallet if I had one.

Brand Bank Debit Card: This is a very local bank that I have had an account with since I was born. They don't have incredibly lucrative rewards for banking with them, but their customer service is phenomenal! In the past, they have stayed open late for me, closed an account for me when I was out of town, and worked out a way to get a check to my mom without me driving an hour out of my way to make it happen.

A few other good things about this bank – the cashback rewards, being able to submit checks over the phone, and fast(!!) transfers between bank accounts (i.e. checking and savings accounts within Brand Bank).

Cash: Justin doesn't keep too much cash in his wallet, and I don't really keep cash on me either. In fact, I'm actually known for hiding cash from myself around the house. If you don't see it, you can't spend it! I'll forget about the cash and get surprised when I find it. It's really a fun way to live, but the interest rates aren't too good. ;)

Capital One 360 Bank Card: At Thanksgiving we took advantage of a promotion and opened a bank account with them. It's nice that the checking account earns interest. We're considering making this account our primary one, but this has not happened yet. So far we like dealing with Capital One just fine, but it's definitely nice knowing that we have other checking accounts that aren't internet based. If you are looking for an account that earns interest, this is a pretty good one to check out.

Charles Schwab Bank Card: We just opened an account with them this week. Free ATM usage and not having to pay an exchange rate in Europe were key factors in our decision. It's so nice having a bank you can rely on to provide small benefits even when traveling.

Chase Freedom: We got this credit card, because it was no fees to transfer other debt to and we would have a year and a half to pay it off interest free. We aren't really in a good place to do that today, but in the next few months we will be. We are sooooo ready for this card to be paid off and out of our lives. I do recommend getting this card if you are on your way to paying down debt or need a short term loan through an interest free credit card.

Costco Amex: If you are going to have a Costco membership, you might as well get this credit card. It supposedly ups the amount of cashback you get on Costco purchases. The credit card fee is the cost of membership to Costco, so that's nice. Plus, it's Amex. I don't know too many people that don't like Amex.

Health Insurance Card: This little card will make it easier to get service when I go to the hospital, and it helps me pay for doctor's visits. I have a love/hate relationship with it.

License: self-explanatory. Ugly picture and all.

store cards: I need my Kroger card to get the best Kroger deals. I also have a card for Menchies frozen yogurt and a nail salon I frequent. But let's not forget gift cards! Those are my favorite kind of store cards! :)

Suntrust Credit Card: Justin got this credit card before we got married. I think it was his first credit card. It's pretty lackluster; the only exciting bit is getting points for purchases. Even the points aren't worth too much though.

Suntrust Bank Card: Justin had a bank account with Suntrust long before I met him. I'm not really a fan of Suntrust and I haven't had the best experience with them, but I can understand wanting to stick with what you know. Suntrust is our primary account, the one we pay our bills from.

Venture Visa: We got this card for it's lack of foreign transaction fees when thinking about our trip to Europe. In the past 6 months it has been incredibly helpful earning us enough points to obtain $600 in free Amazon money! You get 2 points per dollar spent, and if you cash out for Amazon gift cards, you can cash out at 1 point per dollar. It adds up fast! Plus, there is added purchase protection that you can read about on Venture's website. The first year there is no fee for the card, but afterwards it's $59 per year. If we had paid the fee this year, the card would still have paid for itself a few times over. In our first year of using this card, we don't have any real complaints.

Do you take the time to think about your finances monthly? Do you have a bank card or credit card that you find particularly beneficial in your wallet? Do you have any of the same cards as I do?

* Participate in the A-Z blogging challenge with me! You know you want to! :)

I definitely try to think about our finances. We're saving for a new house, so it's important to put as much money away as possible. Looks like you're doing a great job of tracking things.

ReplyDeleteThat's awesome! We're doing the exact same thing, so it is definitely important to keep track of finances. :)

Delete