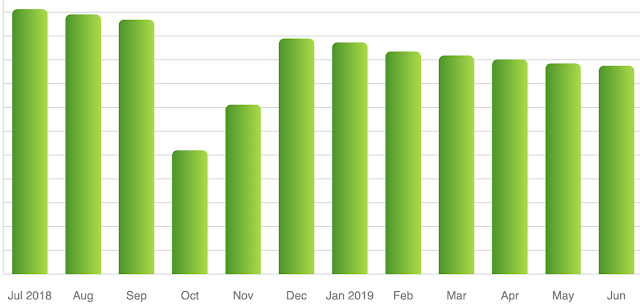

Here's month #6:

Spending:

|

| green = this year, yellow = last year |

Compared to Last Year:

• We spent more on shopping, bills, entertainment (ice skating), travel, and gifts.

• We spent less on food & dining, auto & transport, personal care, fees.

|

| dotted line - last month; green line - this month |

Compared to Last Month:

• We spent more on shopping, food & dining, and entertainment (ice skating).

• We spent less on bills, auto and transport, personal care, travel, gifts and donations, and fees and charges.

So, essentially, electronics were our downfall this month. Well, that and food.

Where We Spent Our Money:

Top 10 Merchants:

1. Apple (fixing Justin's laptop)

2. Free People (clothes for me)

3. Amazon (camera accessories, groceries, organization accessories)

4. Kroger (groceries)

5. Aperturent (camera rental)

6. Electricity

7. Costco (groceries, towels, flowers for my grandmother)

8. Wal Mart (back up hard drive)

9. Ice Forum (ice skating)

10. Hospital (guest house, parking, food)

Top 10 Categories:

1. Shopping (clothes for me, camera batteries + charger, star follower for the camera, rental camera, computer stand, fixing Justin's computer)

2. Food & Dining (lots of eating out because of hospital visits)

3. Bills & Utilities

4. Auto & Transport (parking for airport interview, hospital parking charges)

5. Entertainment (ice skating)

6. Personal Care (hair cuts, dry cleaning)

7. Travel (charges for hospital guest house rental)

8. Financial Charges (life insurance)

9. Gifts & Donations (flowers and popsicles for my grandmother, phone charger for my dad)

10. Fees & Charges (interest charge)

Budgeting:

✓+ Gas & Fuel – under

✓+ Public transport – not used

✓+Mobile Phone – under

✓+ Groceries – over

✗ Restaurants – under

✗ Hair Appointments – under

✗ Everything Else – over

Net Income:

Debt:

|

| student loans |

|

| credit cards |

Numbers:

* Loan Payoff Date 11/1/22

* Emergency Funds: $7334* Credit Scores: 770 (Justin), 797, 801 (me)

Overview of the Biggest Impacts This Month:

1. My dad and grandmother were both in the hospital for a week each. We had to take care of my mom, who was falling apart, and take flowers to my grandmother. I also lost a few days of work to time spent in the hospital.

2. My husband dropped his laptop and broke his screen. Then, when the computer he was going to use as a replacement had a problem with updates we had to purchase an extra hard drive.

3. Prep for LA. – We bought a device to help me capture the stars with my camera! We also are renting a camera for our trip. Finally, I bought 2 extra camera batteries and a Canon-branded charger.

4. Clothes – I needed summer clothes. Was this the time to purchase them? No, probably not.

5. We paid for 15 sessions of ice skating at once and they gave us 2 sessions free!

What went wrong this month?

1. Family members going into the hospital.

2. Husband dropping his laptop.

3. Other laptop problems.

4. One of the credit cards not updating in Mint.

5. Spending more than we did last month and this month last year. 😳

What went wrong this month?

1. Family members going into the hospital.

2. Husband dropping his laptop.

3. Other laptop problems.

4. One of the credit cards not updating in Mint.

5. Spending more than we did last month and this month last year. 😳

What went right this month?

1. Found a cheaper price on a car rental for LA!

2. Received cashback for a price match with Citi!

3. Found a place to rent a better camera for shooting the stars and didn't have to spend $2000 for the camera! (Though I'm going to want the camera, so that's going to be its own problem.)

4. Credit scores are going up!

5. Loans and credit cards are going down (however slowly).

Financial plans/goals for July?

1. Find a new dry cleaner. The one I'm using isn't getting my clothes clean. Why am I paying for a service that isn't working? 🙄

2. Write Chase so that I don't lose my right to sue them! (They are updating terms and conditions. You have to notify them by August that you don't want to be part of it.)

3. Return clothing if I'm not going to wear it. 🙄

4. Watch the grocery budget. Don't buy anything unnecessary.

5. Use the correct credit cards for 5% cashback. (Freedom for gas, Discover for restaurants)

With so much time spent in the hospital and the huge expense that was a broken laptop, I feel like Justin and I aren't doing too badly this month. I do worry what a trip to LA will do to our finances, but we already have so much planned.

On the upside, I'm really excited about having the chance to photograph the stars in Joshua Tree National Park! And I'm planning on shooting the fireworks for the fourth of July while in LA too!

Do you tend to find that accomplishing things on your bucket list cost more than you really should be spending? Do you think that's why most people don't have a bucket list? And if they do, maybe they don't try to accomplish as much as they could?

Financial Resolution Goals 2019