|

| Photo via VisualHunt |

Some of you are new to my blog, so let me recap:

In the first few months of marriage, I let my husband handle all of the expenses. I didn't take time to look at anything financial. That was his job right? As husband? As "head of the household"? (Of course, this goes against the assumption that I would ever let anyone rule over me! I'm pretty stubborn.)

Anyway, only a few months into the marriage, I realized nothing was happening. Instead of our debts being paid down, we were … doing the opposite?

So, with pen and paper in hand I wrote out all of our monthly expenses. I organized our bills so that, the two times of month Justin got paid, would be split evenly among all. (My payment schedule used to be monthly and is now weekly, so we've never gone by that.)

The experience of writing down all of our bills and splitting them up was excruciating, time consuming, and hurt my non-analytical brain. To make matters worse, I didn't even get everything right! I missed accounting for a large number of bills! The first month an extra charge occurred for a bill I hadn't account for, I found myself in shock! Was I going to have to go through the whole process again?

Well, the answer was yes. By December of 2012, I was at it again. Comparing our budgets and breaking them apart, making them work for us rather than against us. That's when I realized that budgeting and dealing with finances is not a one time thing; it's something you have to do over and over and over again…

I started blogging about my financial goals to keep me in check. Blog readers are a great way to keep one accountable to their goals.

And so, once a month (typically), I update the blog on #moneyMonday sharing where I am and what I have achieved. I've definitely noticed in the time since beginning this project that what is going on in my life and how stressed I am definitely affects how well I do on any given month. It can be hard to stay on top of budgeting!

If you want to read my financial story, I recommend starting here. All of my other posts related to the topic of money can be found here.

Spending:

|

| Spending green = this year; yellow = last |

|

| Spending (this month only) green = this year; yellow = last |

• Problem areas seem to be food (Justin's fault) and travel (mine).

• But look at how little (clothes) shopping I've done recently! I'd call that a win! :)

• Justin managed to get the sebring fixed last month, so gas (despite being higher in cost) should be lower overall this month. (He was driving a Ford F-150.)

• Fees and charges: We had to pay for our Chase Sapphire rewards card which we agreed was worth it. Since owning it, we have been able to book and pay for 4 one way seats on Amtrak from NYC to Boston (~$400), reserve rooms at the Hyatt Regency Jersey City Hotel (~$200) and Hotel Bellevue ($486.47) in Dresden making our total cost of owning the card this year ~+$986.47. Yeah, I think it's worth owning/paying a fee for. :)

• 90% of the business service charges and $150 spent in travel will be reimbursed.

Income

|

| Income green = this year; yellow = last |

Net Income

|

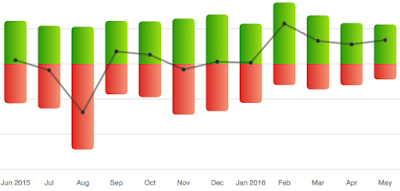

| Net Income Graph green = positive; red = negative |

• We faced a slump from November to January and then overcame it. Our current average is +$882/month. I'd like to see that number improved, and I'm sure it will once August falls of the graph (when we bought my car).

• Then again, ticket prices for Paris just went up (and we don't have ours yet). :( I'm not sure what to expect from that and how it will affect our net income.

Numbers

• June 2021 loan payoff date (improved by one month!)

• Jan 2017 credit card payoff date (worse by two months)

• emergency fund: $10,813 out of $12,000 goal

• Investments @ -5.13% :(

• Justin got approved for the Delta Gold Amex! So his credit score went up, he will be receiving 60,000 Delta miles, and a $50 credit!

• He also got approved for the Citi Double Points Rewards Card which, when we cancel our Capital One Venture, will put an additional $50/yr back in our pockets and still give us the 2% back we deserve!

How do you keep yourself accountable? Do you have a budget that you look at monthly? What are some of the best ways you've found to save money?

Sounds like you've got a plan. Good for you.

ReplyDeleteI wish I'm not too lazy to do this soon. We need this!!!! :)

ReplyDeleteFrankly I didn't pay close attention to the details, let me just say I like the fact that you guys spend your money on travel and food! I also like the colorful charts you made. Can you tell I am not a financial whizz either?

ReplyDelete