In the past I've tried to a financial overview. Mostly it's for myself, but you all can follow along if you want.

One of the top priorities in my husband's and my financial life is paying down debt. Specifically student loans. We also have a car loan and credit card debt. I'm not going to lie – even with the amount of money my husband brings home in a year (which is more than average), it is still hard to conquer debt. We owed more than $100,000 between the two of us right out of college. It is hard to stay focused on paying down the debt and not spending any extra on extravagances like travel, morning coffee, or a new outfit. The struggle got even more real in 2016 when my boss threatened to fire me if I didn't replace my car ASAP. (It had broken down 4 times in a month; I don't blame her.) In the past six years we also had to replace my husband's truck, both of our laptops, and we felt it was only the right thing to do to attend a few weddings overseas.

Everything added up, the debt pay down process has been a slow and steady race with missteps along the way. I am happy to report, however, that the debt is getting paid down though. Of course, there is always room for improvement. Maybe 2019 will be our year.

DEBT

Total decrease over the past 6 years: $26,497

STUDENT LOAN DEBT

Decrease this year $8,144.86

Total decrease over the past 6 years $38,281.43

Payoff Date: 12/1/22 (improved by just under a year! Last year's date was August 2023.)

We refinanced my student loans within the past month to get a 2.5% variable interest rate. It may be time to refinance my husband's loans as well; the interest from his last refinancing has crept up to over 5% which isn't a huge increase, but if we could get it back down, that would be good.

CAR LOAN

Payoff Date: 4/1/19, an improvement of two months from last year! Paying off the car now seems easily within reach!

CREDIT CARDS

We have spent more on credit cards this year than we have in the past.

This year I think one of my biggest problems with credit cards, the one that can easily be corrected, is not allowing companies to take advantage by charging interest when we are unable to pay the bill in full. We've mostly thought the accruing interest was our fault and that we deserved it rather than using high credit scores to move the "problem" to another card with a 0% interest rate.

If you are in this same situation, don't be like us. Move the amount you owe to a card with 0% interest like Chase Slate and continue to work on paying it down without worrying about the extra interest adding up and costing more in the long run.

While I usually provide a payoff date in my financial reviews, I feel like Mint isn't giving me the correct information regarding the cards I have on file with them. It's currently suggesting a date of May 2020. We'll see.

––––––––––––––––––

Below, I cover fees which I want to explain before I share.

While I am complaining about interest fees which should be rightly avoided if at all possible, I do think credit cards can be helpful for taking your money further. Cards, like Venture, offer 2% back on all purchases which is essentially an extra $.02 for every dollar you spend on the card. While it does cost a yearly fee of $95, you can easily get that back if you use it to obtain TSA Pre✓, an option that can save you time at the airport (and worth $100 if bought outright). So, I see some fees for credit cards as worthwhile, but it all depends on how often you use the card and whether or not you can get value from the card.

Regardless of what the fee is though, I think the goal should always be getting as much value from the card and paying as little in interest as possible on the card as possible. Justin and I spend a lot of money on credit card fees (and this year we spent a lot on interest), so ideally in 2019, we should aim to get our interest expenses down and only keep the credit cards we get value from. I've written about the pros and cons of each of our cards below and shared my initial thoughts on which cards we should keep and which we should cancel in 2019. Obviously, the more time you spend researching which cards will work best for you, the more you will save.

FEES

Credit Cards Without Fees:

Amex Blue Cash Everyday – 3% cashback at grocery stores, 2% cashback at gas stations and department stores

Amex Blue Delta Skymiles – Kept for maintaining credit history and credit score.

Bank of America Cashback – free entrance to select museums on the first weekend of the month

Chase Freedom – 5x Chase points on rotating categories

Chase Disney – Kept for maintaining credit history and credit score.

Citi Double Cashback Card – 2% cashback on all purchases

Discover It – rotating 5% cashback categories

Suntrust Cash Rewards – 2% cashback on gas and grocery

Credit Cards With Fees:

Amex Gold Delta Skymiles – $95 fee, free checked bag for everyone that flies with me, early boarding with Delta and cobranded companies, 2x miles on Delta purchases (drinks, snacks, bags, flights)

Capital One Venture – $95 fee, 10x the miles when booking hotels with hotels.com, no foreign transaction fee, credit for Global Entry/Pre✓, 2% cashback on purchases

Chase Sapphire Preferred – $95 fee, 2x points on travel and dining, no foreign transaction fees

Chase Sapphire Reserve✓, complimentary lounge access, option to use The Luxury Hotel and Resorts Collection

Costco Anywhere Card – fee depends on Costco membership ($120 for us), 4% cashback at gas stations, 3% cashback at restaurants and on travel, 2% cashback at Costco

Justin and I may want to consider dropping Chase Freedom and Chase Sapphire Preferred in the next year since we have the Sapphire Reserve and Discover cards. Dropping the cards would save us $95 per year. We may also want to consider looking at new cards to see if there are any that will better work for us in the future.

THIS YEAR COMPARED TO LAST

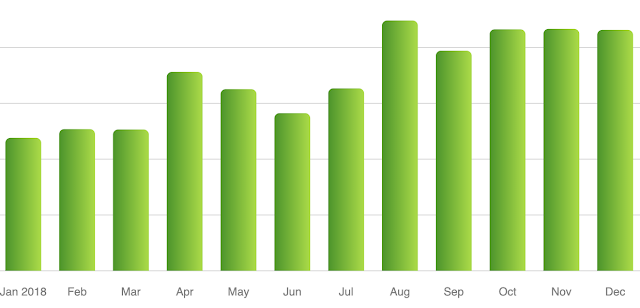

As a personal goal, I typically try to spend less from one year to the next and a great way to look at it is by month. I admit getting distracted and busy as the year went on which made it harder to stick to my goal. Maybe in 2019 we will do better? We spent more in seven months this year compared to last and $13,000 more total. :(

I am grateful that we only rarely spent more than we made, though. Obviously, the goal is to never do that, but it can be easier said than done when you get distracted and busy with life. I've heard great things about Dave Ramsey and separating your money into envelopes, but then you aren't getting the benefit of money back through credit cards, so … complications.

WHERE OUR MONEY WENT

Categories

1. Food & Dining

2. Travel

3. Shopping

4. Auto & Transport

5. Bills & Utilities

6. Gifts & Donations

7. Personal Care

8. Financial

9. Entertainment

10. Taxes

Stores

1. Costco (includes new tires)

2. Boots N All (flight to Paris, Cairo, Frankfurt, home x 2)

3. Kroger

4. Electricity

5. Best Buy (laptop, radio for my mom, camera memory cards)

6. Unclaimed Baggage Store (used cell phone, used laptop x 2)

7. Homeaway (Rental property for stay in NYC during September with friends)

8. Publix

9. Progressive (car insurance)

10. Delta (flight to California, NYC)

11. Quiktrip

12. Amazon

NET INCOME

We spent more than we made during two months this year. Yikes!

NET WORTH

I am grateful to see our net worth continuing to go up, though. Paying off debt is a hard and long process.

Unfortunately, our stocks aren't doing quite as well at a drop of -60.24%. I guess that's the chance you take with stocks.

ASSETS

Justin and I have put less time and attention toward assets this year as we worked on our debt. Toward the end however, Justin started putting a bit extra away to buy stocks within his company. He has been given stock options which, should his start up company sell, could bring in some money. It is always a risk investing, but I can understanding wanting to put money where you've spent ten years of your life working.

Overview of the biggest impacts on our finances in 2018:

1. April travel to California (to visit Omar and fiancé)

2. Omar's wedding (including travel to NYC, Europe, and Egypt)

3. the purchase of 3 laptops and a DROBO (Raid backup system)

4. shopping in general 😳 (The top of the list will be car tires, a freezer, Christmas gifts, and a garage door opener among other things … like clothes and shoes.)

5. car insurance (nearly $2000!!)

6. paying taxes ($700)

7. Food expenses were up. 😞We bought a lot of food for other people. We also spent more on alcohol than we have in the past.

So where were the downfalls? What went wrong financially this year?

1. Forgetting that fees don't have to be a normal part of life. Credit card companies do that to make money. It's not personal; it's business.

2. Trying to help my parents and brother when we really needed to focus on ourselves and our finances.

3. The people I work for opening a credit account in my name without my knowledge and causing my credit score to dip down. (But it's all fixed now! Credit score never fully recovered, though…)

4. Travel to California that resulted in a drowned laptop unable to fully recover. So $$$ turned into $$$$ when I had to replace it. (We won't add on the additional $$$$ spent on going to Egypt, also a result of our trip to California.)

5. Dîner En Blanc also felt like a waste of money. The location was boring and we missed most of the event. It didn't cost too terribly much, but it is still money I would rather have put toward something else.

What went right this year?

1. Getting a decrease in my student loan interest rate! YAY me!

2. Learning how to use Citi's cashback feature. We have gotten more than $100 back in purchases bringing the price of items sometimes below $10!

3. We spent less on car expenses this year!

4. Started putting money towards Justin's company's stocks.

5. Getting extra work and making more money. With all of the mistakes we made this year, the extra money is helpful.

What are our plans/goals for next year?

1. Consider applying for a loan that will lower Justin's student loan interest rate.

2. Get rid of (or change out) unnecessary credit cards.

3. Pay off the Mazda.

4. Lower food spending. And shopping costs.

5. Try to find car insurance that costs less.

--------------------------------------------------------------------------------------------------------

Obviously we have some work to do, but maybe 2018 will have led to a stronger and smarter 2019? I can only hope.

Do you have financial goals you worked on this year? How did that go? Anything you need to improve on in 2019?

OLD FINANCIAL REVIEWS: