|

| How much cash do you think is in this wad? |

Over the past few years, 3 and a few months to be sorta' specific, my husband and I have been attempting to pay down our student loan debt piece by piece without crippling the lifestyle we have come to know and enjoy. To be straight with you, we owe a house in debt, even still after 2 years of steadily paying it down. Currently we are living an hour outside the city we work and play in just to save money. Overall, this way of life has been helpful and we've saved far more in the past year that this has been the case than we did in the two years prior where we were renting a home inside the city. In case you haven't been following along, every month I take a second to look back and see the good we've accomplished, the bad we've instigated, and what we should improve in the coming month.

So far this summer has not been kind. I was suppose to have a full time job during June and July, up until my employer had to go into the hospital for a surgery. With her being home for 6 weeks, I found myself without a job … and instead stressed out about my brother's baby shower invitations. (#strike1) In an attempt to save money, I had Justin driving my car to work every day minimizing our gas usage from $100+ a week to just over $50. (You can't complain about spending half as much!) But… on one such morning that he was driving my car, a rock got kicked up from a trucker and my windshield broke right in front of the driver's field of view. (#strike2) Finally, as if we hadn't had enough life complications, my phone screen shattered (to the point of being unusable) and I got into a car accident taking both my car and phone out of commission for a week AND I lost out on a day of full-time work (my first day back!). (#strike456) Needless to say, this summer has put a strain on our financial goals. Argh. #excuses

Now that that's out of the way, let's take a look at the damage:

|

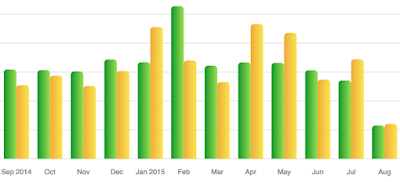

| This year's (green) spending comparison to last year's (yellow) |

|

| Earning over the course of the year… We're up in total by $100! But we received much less income for the month of July this year than last. |

With Mint not showing me the comparisons between this year and last, I find that I have much less incentive to spend less comparatively than I did before. The screen shots you see above are from hacks other mint users have provided for the Chrome and Firefox browsers which you have to input into the JavaScript Console EVERY TIME you want to compare. This is easy to do for writing a blog post, but when you are stressing out about baby shower invitations, a broken phone, and a broken car, it's much more difficult to take the time to insert the code and actually think about the process. I'm currently considering switching to a different financial tool since Mint customer service has not responded or fixed this problem yet, but even that takes time and doing.

Either way, whether we spent more due to extra vacations (woohoo!), being unable to compare spending, or because everything we own broke on us… we did make some minute improvements to our finances and way of living.

The positives:

|

| Our debts are the lowest they've ever been! Student loans down by 8% and Credit cards down by ~66%! |

|

| Our net worth improved by ~26% in the past 12 months. |

• Investments are up by .63% or the equivalent of $28! heh. And we accrued $5 in interest.

• We were under budget for gas! With me working from home, Justin was able to drive my car saving approximately 40% per week or approximately $200 per month difference from May, the last time month I was working out of the house. Luckily, now that I'm back to working full time, we will be receiving 5% back on all of the gas we purchase until the end of September by using our Chase Freedom card. This will be nice. :)

• Vacations! + Dinner at FIG!

• And, lastly, a new (to us) computer for Justin. Technically we bought the laptop in June, but we finished the purchase by getting Justin a large screen (28 inches) to work from during the Amazon Prime Day sale. We saved $400 on the purchase and used our Discover card to get an additional 10% cash back! It was definitely a fantastic deal! Now he can work from home if he wants.

|

| If only it were this easy… |

Now, here is where we need to improve:

• Food budget. We ate like royalty during the month of July spending twice our normal budget! Granted there were a few meals where we paid for others as well as a mystery shop or two (costing upwards of $100!) that we will later be reimbursed for, but we still spent a lot. Unfortunately I've found that the busier we are, the more we spend on food because we aren't home to cook. There isn't much I can do about that though; it's just a fact.

• Our "everything else" budget. The way our budget is set up is that we have our typical expenses and then "everything else" which includes clothing, entertainment, books, travel, car parts and repair, gifts, etc… During July, in particular, we had Knights of Columbus dues, car insurance for the next 6 months, our Amazon Prime membership, our Savannah and Charleston hotel costs, car repair and phone repair all wrapped up into one. Basically, this means we spent 86% more than we were budgeted for. (KOC, Amazon Prime, car insurance for 6 months, etc… are not part of our typical monthly budgeting and they all add up quickly even without our surprise expenses or fun purchases.) Is there a better way to handle this budget? I'm sure… Do I know how? No, not on Mint…

• Putting more towards student loans and paying off debt. Our student loan date got pushed back to Feb. 2021 from Aug. 2020. :(

|

| They happen. |

And finally, my expectations for the month of August:

• More spending. We're going to NYC and Boston with Justin's parents to visit some relatives and we are going to try to use our Sapphire Preferred points to travel between the two cities via Amtrak! It will be our first experience using our Sapphire points and I am so excited at the cash it will save us! YAY! (Plus, the views!)

• The baby shower is upon us! There are also lots of family birthdays coming up (my brother, grandfather, Justin, and Justin's dad). Woo money sinkhole. We won't even mention that my nephew is due at the end of the month which probably means another spontaneous mini vacation to the Savannah area to see the new family member. :)

• Most likely applying for either the Amex Fidelity or Citi Double Cashback card. Our Capital One Venture (which I love so much!) annual fee is coming due this month. Since the Amex and Citi cards are fee free and provide 2% cashback on everyday purchases, we will have to take all of the benefits into consideration to discover which card is best for us.

• Possibly opening a new savings account. SmartyPig has lowered their interest rates to .75% which is awful compared to other bank accounts. It might be time to switch and if we got a bank bonus, that wouldn't be the end of the world. ;)

|

| What you've been waiting for… Did you skip ahead? |

IN CONCLUSION:

• I hate budgets.

• I have a love/hate relationship with money. Food, shelter, and shopping are ftw, but paying for repairs, bills, etc are ftl. #adulting

• I don't understand investing, but I like earning money from money…

• We keep improving but it is a very slow process and there have definitely been setbacks along the way. :(

Food for thought:

• How is your budget looking so far this year?

• Are you happy with any improvements you've made in the past 12 months?

• Can you help me to understand investing?

• Do you know of a better financial site than mint?

• What are your expectations for the month of August?

• Do you see yourself moving toward your financial goals or stalling?